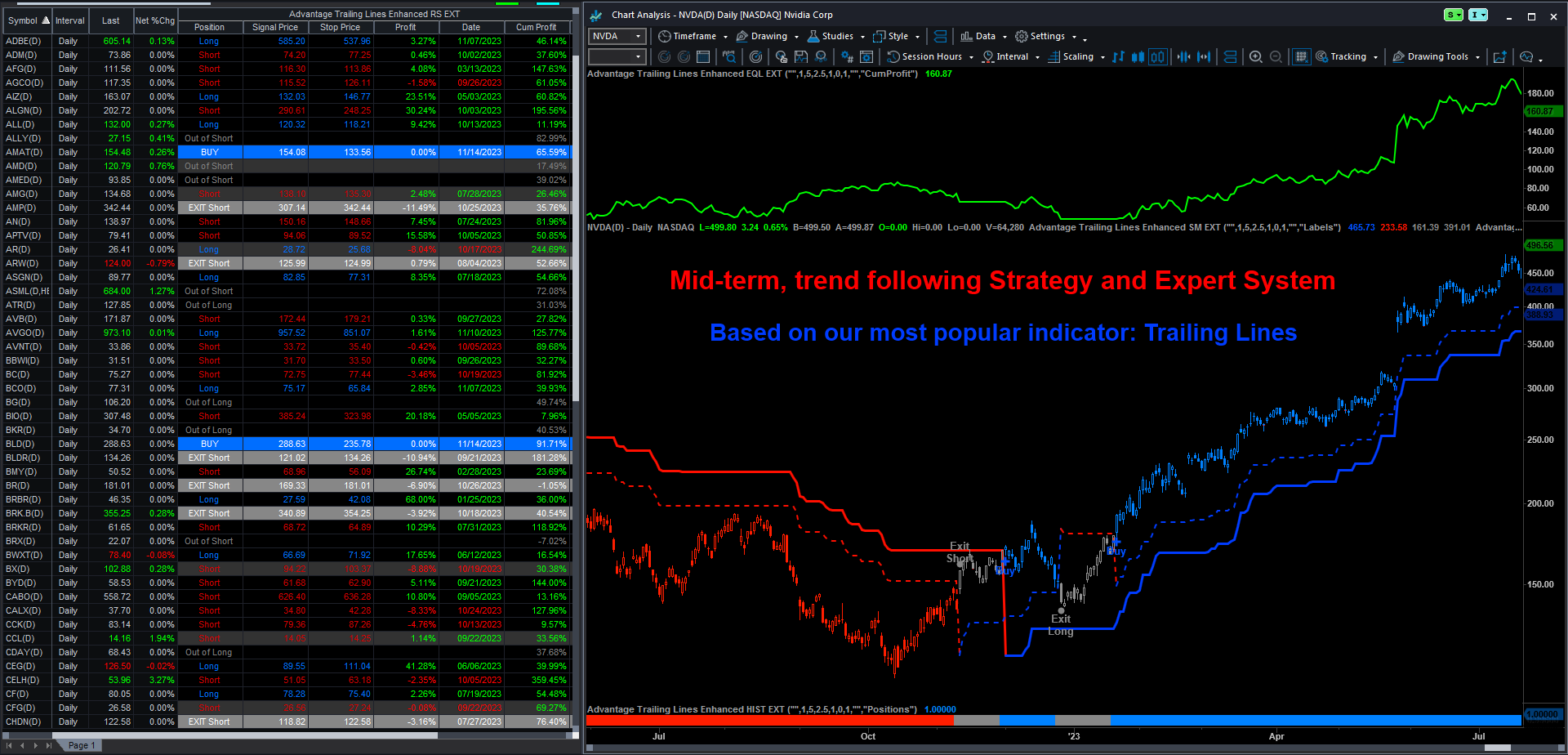

NEW! Trend Following, Mid-term Strategy and Expert System!

Investing in trending markets may seem easy, but in reality, it is often difficult to identify the best moments of a trend change or the occurrence of buy and sell signals. That's why we have developed Advantage Trailing Lines Enhanced - a simple but effective, trend following strategy, which generates profits in long investment horizons. What's important, it is not only a strategy but a whole set of tools for simplifying trading and gaining control over the decision-making process.

Fully Automated Trading Strategies

Why do most of the traders lose?

Trading is extremely difficult. A vast part of the traders quickly lose their assets rather than accumulate them. The latter applies in particular to the futures market where a very large financial leverage operates, and nearly every mistake leads to a loss. The main reason for this state of affairs is the lack of clearly defined trading strategies. The majority of traders make their decisions to buy or sell on impulse, driven by accidental indicator signal, emotions or opinions of others.

How to achieve success?

A strictly defined trading strategy is a key to success on the stock market. It overrides emotions and ensures sound investment decisions. Regardless of whether you employ fundamental or technical analysis, clear buy and sell principles are crucial to successful trading. Logical, well-thought-out trading strategies allow avoiding chaos in decision-making and retain control over what happens in the market. And this is exactly what Advantage Trading offers!

Perfect trading strategies

Even though perfect trading strategies or indicators that always perform well on all the markets do not exist, yet certain methods allow to make the probable gains more likely. The control of emotions alone and the fact of being fully aware of what happens in the futures or stock market make trading much easier. Such an approach allows checking what gains have the given trading strategies brought in the past, and select the tools or techniques which also should earn the largest gains in the future.

Your Advantage to Beat the Market!

If you are thinking about professional trading and search for well-tried tools of technical analysis, check our offer for TradeStation users. Advantage Trading strategies and indicators are already applied by traders worldwide. Take control of your decisions, let them not to be subject to coincidence or emotions. Trade professionally with Advantage Trading!

Advantage Trader

Advantage Fighter

Advantage Miner

Advantage Package

Ultimate Package of the Best Tradestation Indicators!

We gathered our best indicators into one Package, that will help you build profitable strategies tailored exactly to your trading style and markets you trade on. Now, we are adding our new Advantage Oscillator to the Package! Use it in multi-time frame mode to precisly catch tops and bottoms. This is the Advantage you need to Beat the Market!

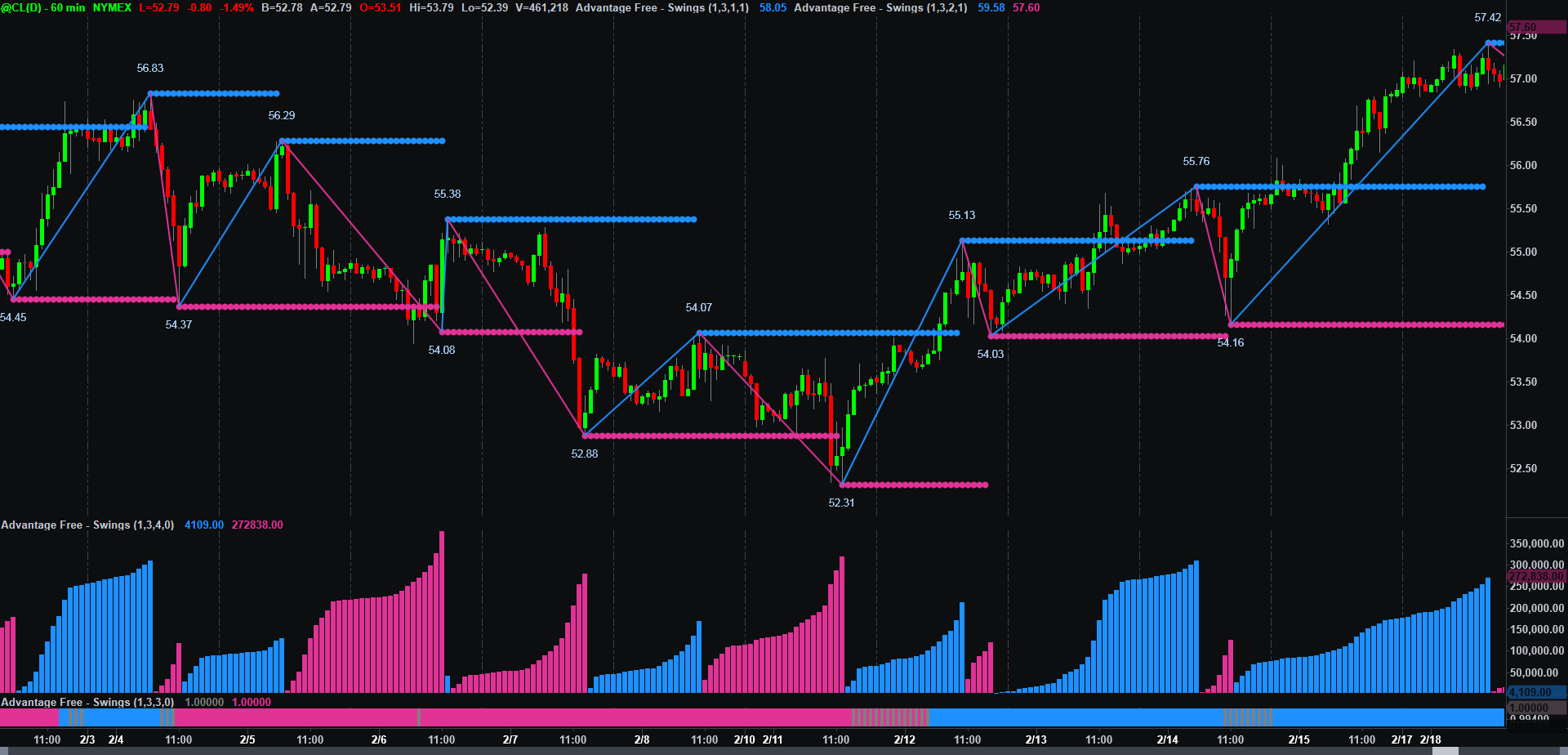

Advantage Swings

Zig-Zag Cumulative Volume based on David H. Weis work! Check our new package of swing indicators! Now, you can identify supports and resistances, analyze relationships between swings and forecast the trend reversal based on David Weis cumulative volume indicator. All you need to catch the best trading opportunities!

![]()