Dig Out Your Gold!

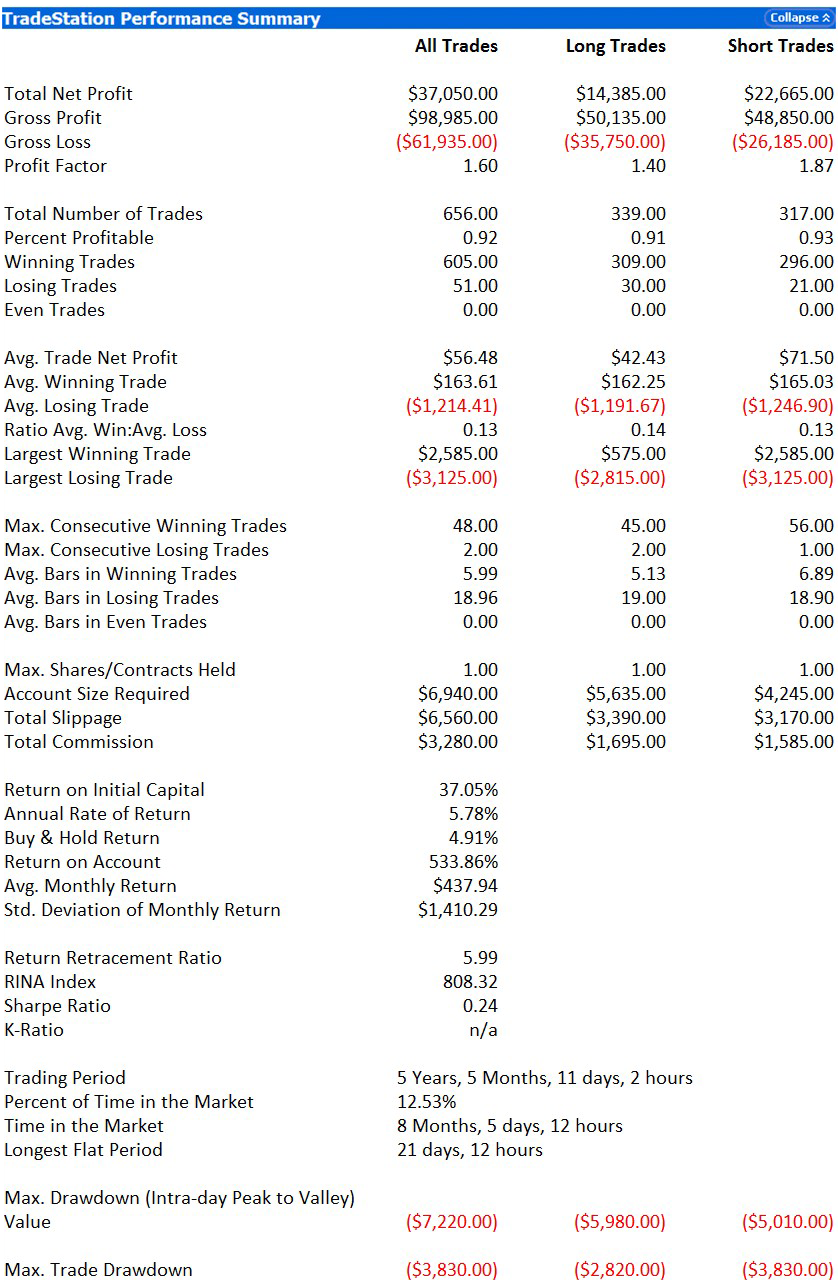

Advantage Miner is fully automated Tradestation mean reversion strategy for Gold and other futures markets. It is based on combination of technical analysis and statistics. It identifies market oversold and overbought for high win ratio signals to buy the end of corrections and quickly take profits when the trend returns. Due to such approach, up to 90% of positions are profitable and the equity line is smooth and stable.

All parameters of the strategy can be optimized or manually refined to gain the best results. There can be set the main parameters like length, setup or trigger and additional like signal sensitivity, trading hours and risk management. The strategy can be tuned to suit various mean reversion markets and personal preferences like preferred session hours and Stop Trailing or Take Profit mode. Although only 1 contract is allowed to trade, the limit can be increase on demand.

The below results are hypothetical - based on the Tradestation strategy performance report. They are presented only for educational purposes, not as investment or trading advice.

Gold Performance

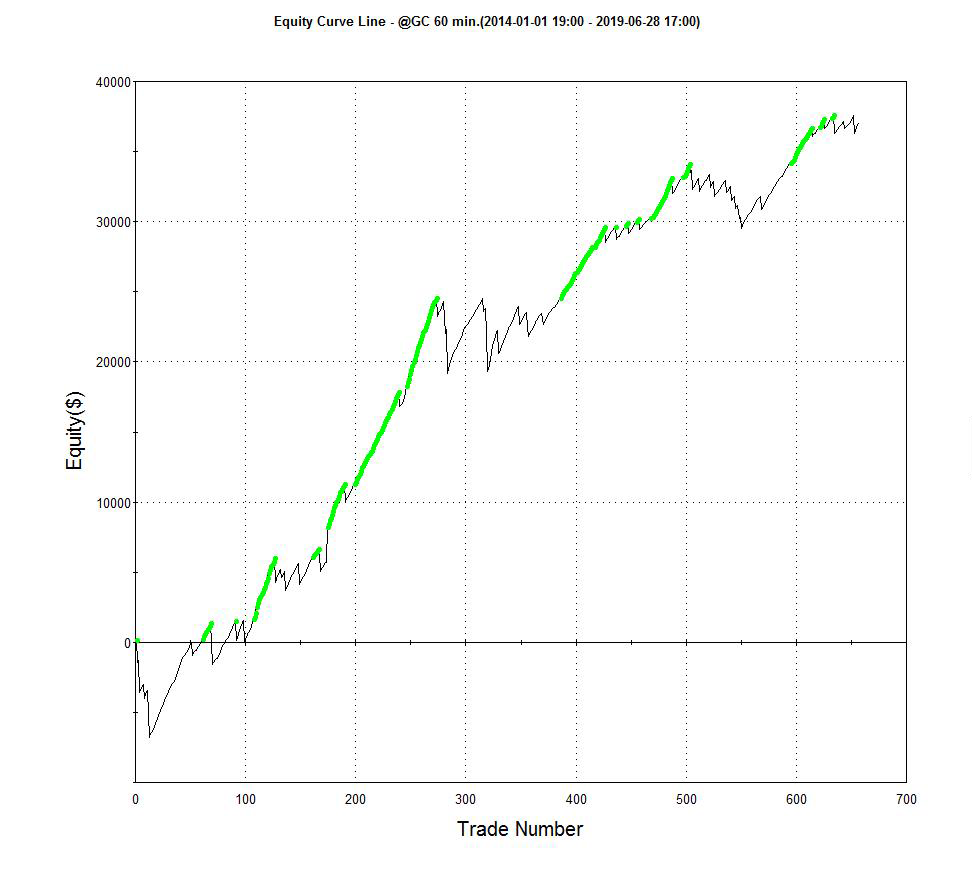

Equity Curve Line

Performance Raport

Performance Reports to download

Advantage Miner Strategy settings:

• Signal_Time_Start

• Signal_Time_End

• Exit_on_EndOfDay

• Strategy_Length

• Setup_Level

• Trigger_Level

• Market_Mode

• Profit_Level

• Signal_Sensitivity

• Trade_Management_OnOff

• StopLoss

• StopTrailing

• TakeProfit

Advantage Trader Strategy properties:

• mean reversion signals

• up to 10 contracts per market

• or shares up to $25 000

• all markets allowed

Price: 25 usd / month

Advantage Miner Manual

|

Advantage Miner - Free 30-Day Trial >>> |

|

| |