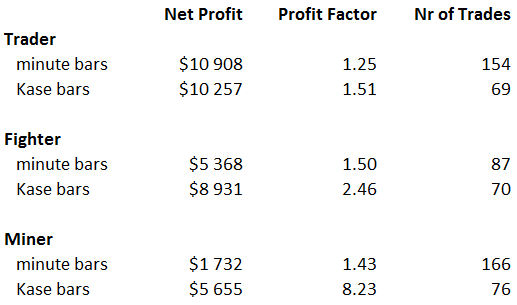

Strategy performance on time vs range bars

What type of bars should be used for trading? Are the range bars better than the time bars? Yes! The answer is short and simple. Strategies based on range bars generate higher profits, fewer trades and better risk metrics.

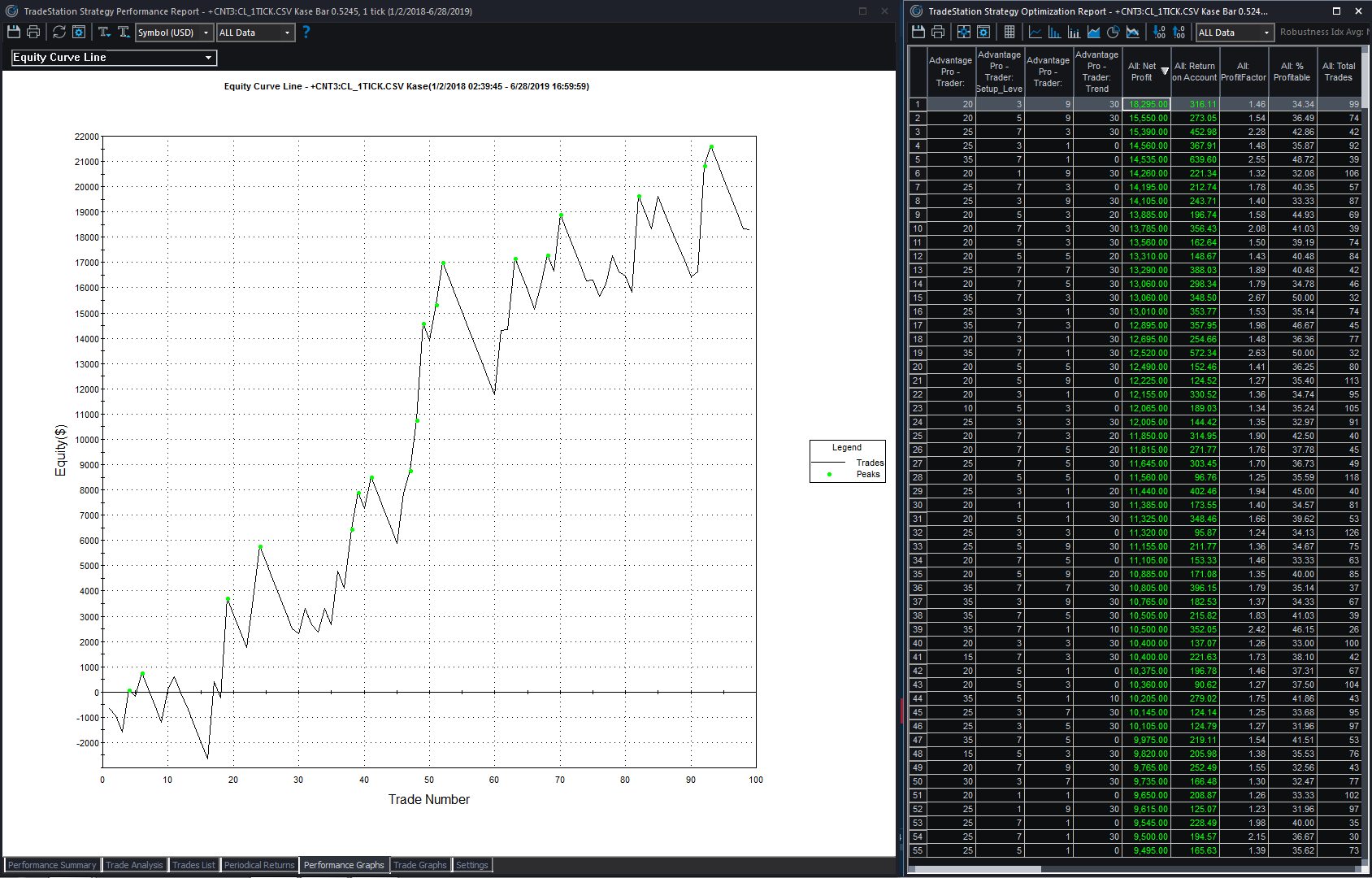

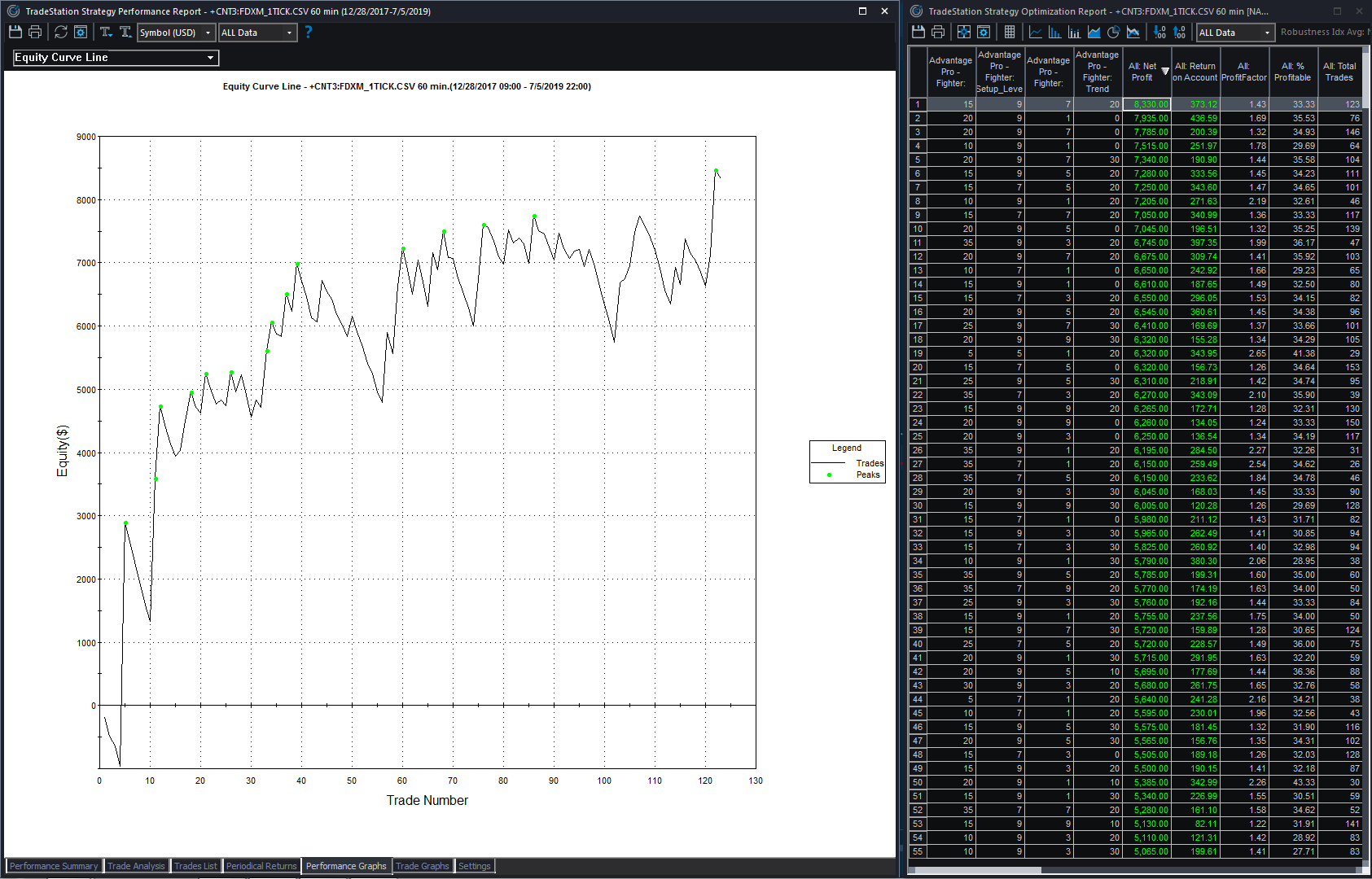

We tested our strategies from the beginning of 2018 to mid-2019. Below is a summary of the top 100 very basic optimization results for Mini DAX, Crude Oil and Gold futures. We made them on time bars and range bars (time bars equivalent based on True Range).

Advantage Trader - CL.F, 60 minutes

• Net Profit: $10 908

• Profit Factor: 1.25

• Number of Trades: 154

Advantage Trader - CL.F, Kase bars

• Net Profit: $10 257

• Profit Factor: 1.51

• Number of Trades: 69

Advantage Fighter - FDXM, 60 minutes

• Net Profit: $5 368

• Profit Factor: 1.50

• Number of Trades: 87

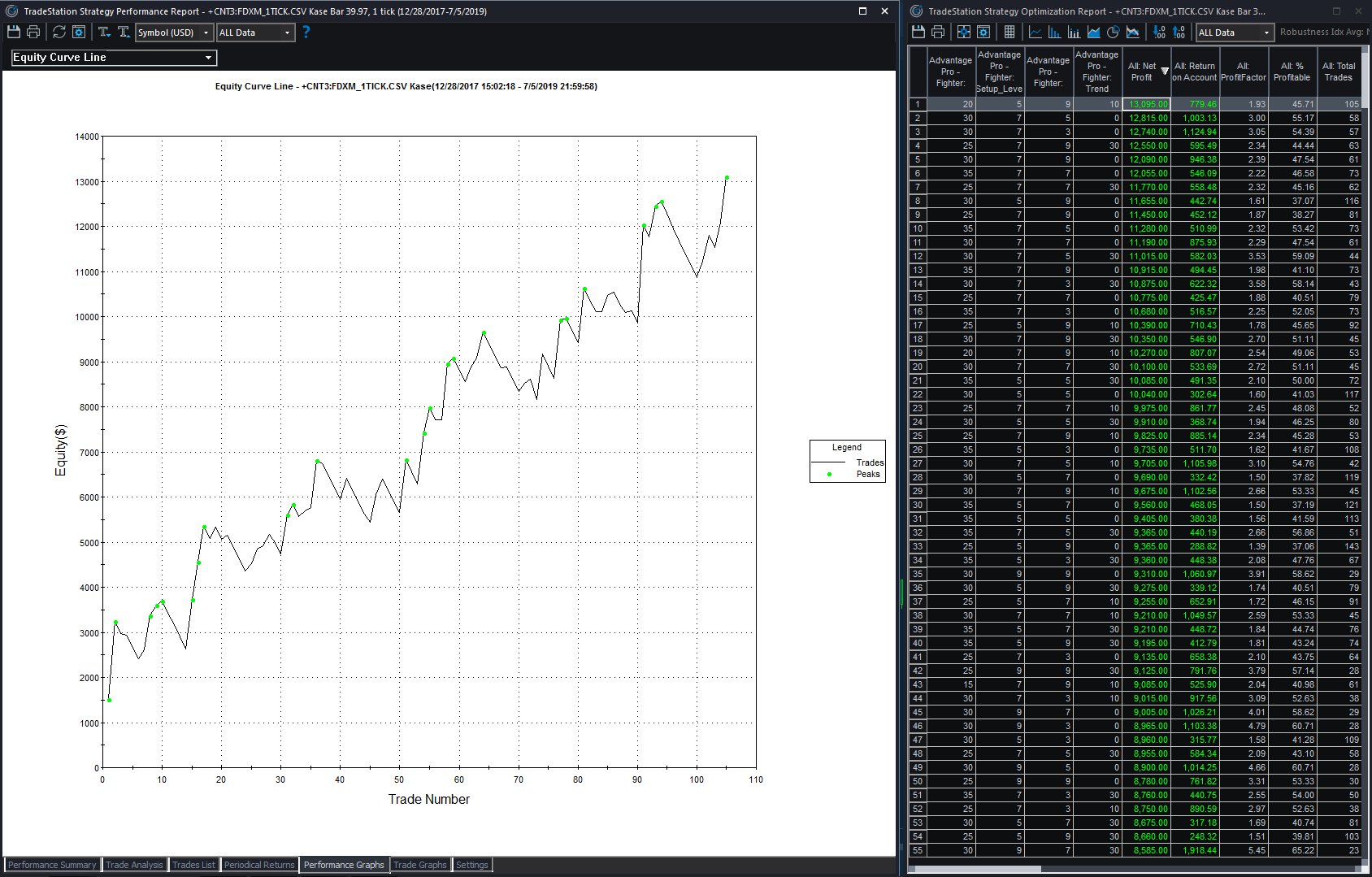

Advantage Fighter - FDXM, Kase bars

• Net Profit: $8 931

• Profit Factor: 2.46

• Number of Trades: 70

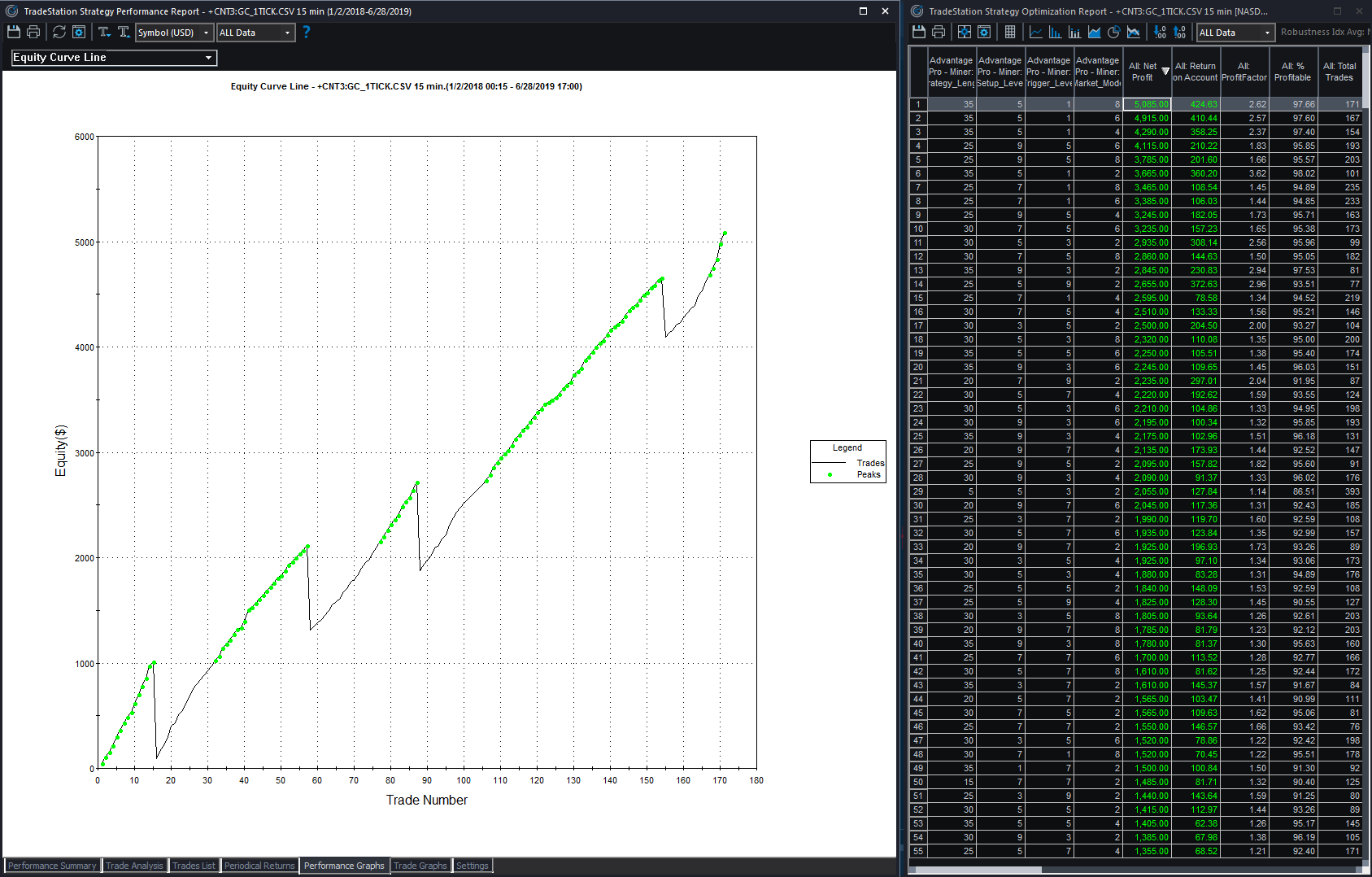

Advantage Trader - GC.F, 15 minutes

• Net Profit: $1 732

• Profit Factor: 1.43

• Number of Trades: 166

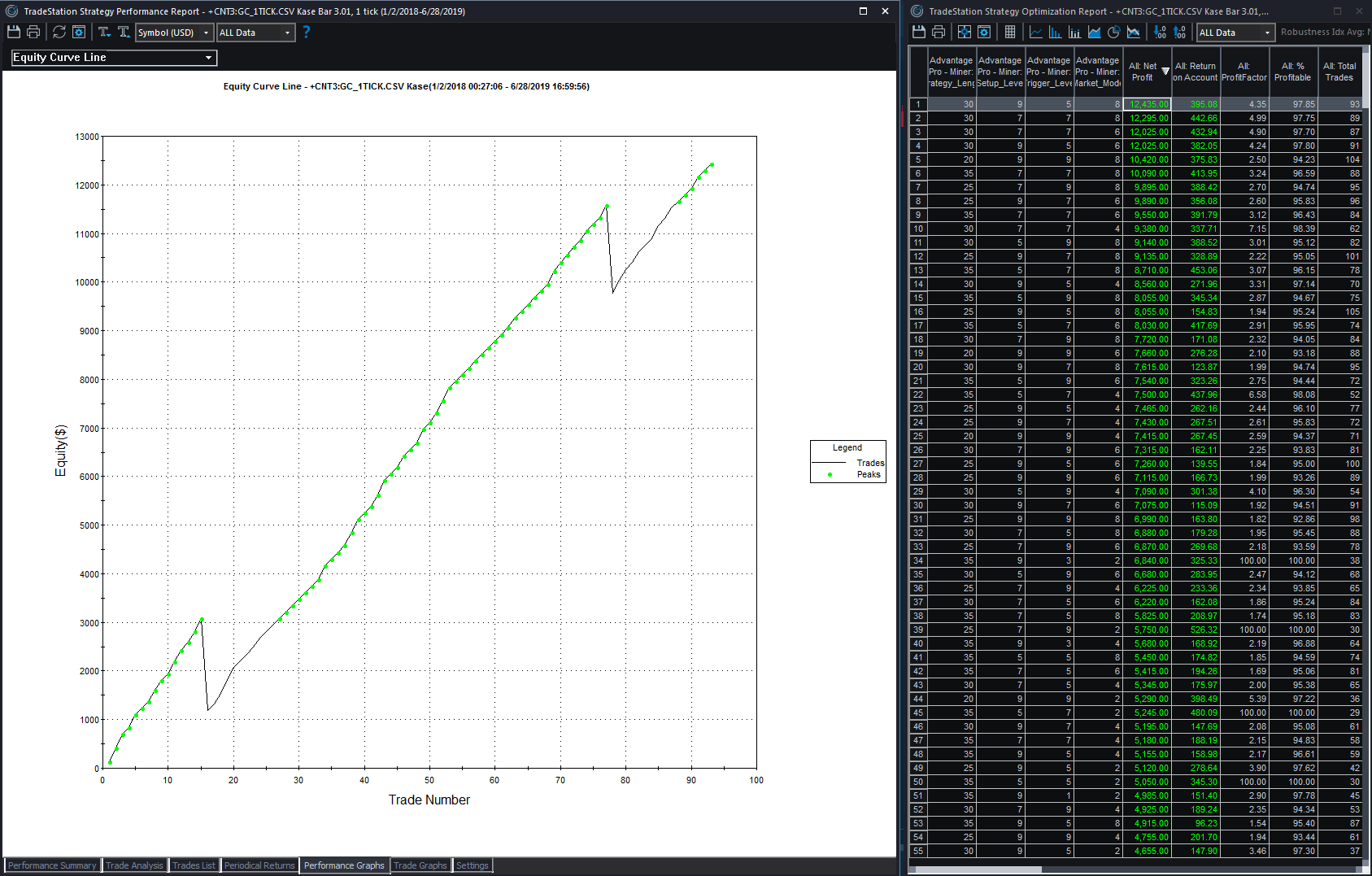

Advantage Trader - GC.F, Kase bars

• Net Profit: $5 655

• Profit Factor: 8.23

• Number of Trades: 76

And a summary below. In most cases range bars are better than time bars!